Gautam Adani is a billionaire industrialist and chairman of Adani Group in India, a multinational company interested in different areas such as energy, logistics, real estate, agribusiness, defense, and financial services.

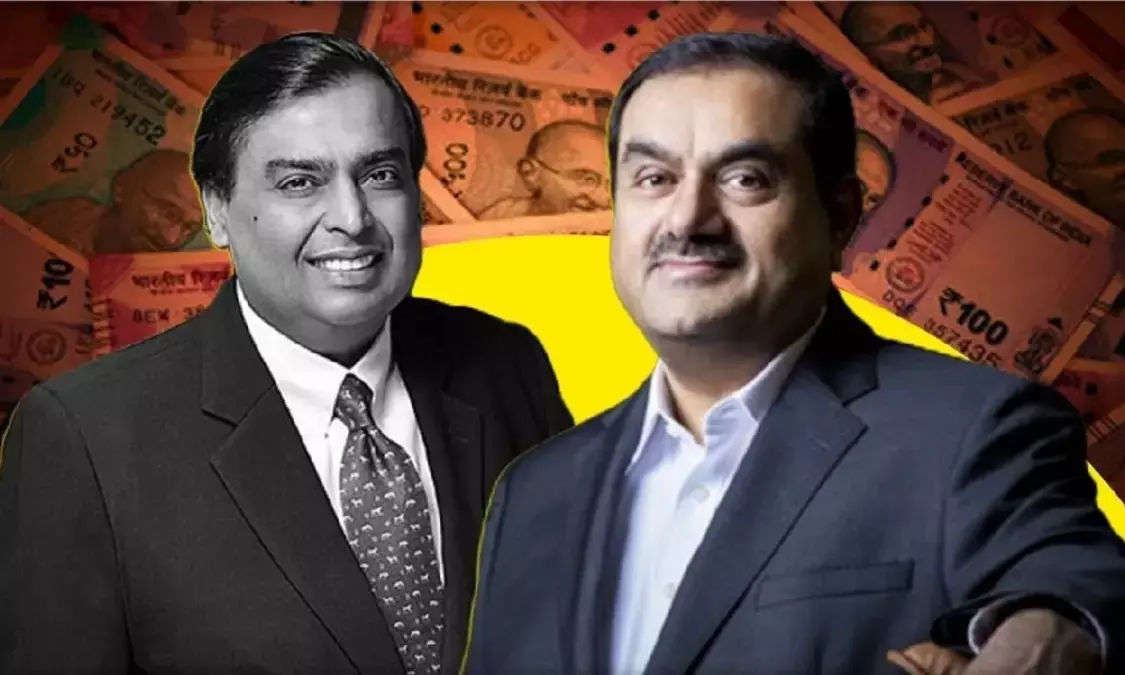

He has become the wealthiest Indian crossing Mukesh Ambani but more on this later, let’s discuss how he started.

Background of Gautam Adani: Richest Man of India

Born in Ahmedabad, he comes from a modest family and is the son of a textile merchant. He was the seventh of his eight siblings who migrated from Tharad for better opportunities.

Adani Enterprises: 1998

Adani discovered Adani Enterprises in 1998, focusing initially on exporting agriculture products. To his surprise, this company expanded like a fire in the woods, allowing great or private sector participation in different industries.

His prominent venture was the making of Mundra Port in Gujrat, which became operational in 1998 and is now the largest port in India.

Overtaking Mukesh Ambani: Gautam Adani

After becoming a billionaire recently Gautam Adani has once again overtaken Mukesh Ambani to reclaim the richest person in Asia title.

The net worth of Adani stands approximately at 111 billion INR, while on the other hand, Ambani’s is at 109 billion INR.

This shift happens because of a significant rise in stock prices of Adani group which rises to 14% following a positive projection by US brokerage Jefferies

Allegations of Fraud and Stock Manipulation: Rise in Stock Market of Adani’s

Despite the allegation that Adani faced stock Manipulation and fraud, the recent stock exchange has changed the game for Adani Group firms in boosting Adani’s wealth, allowing them to surpass Ambani once more. This growth reflects that they recovered from all the allegations.

If we talk more about it around August 23, 2024, Adani is facing mixed stock performance where many things are facing decline as of closing flats, but on the other hand, some are having modest gains like Ambuja Cements and Adani Power is the reason for the rise

Strategic Investments of Adani Groups

A firm doesn’t succeed if there are no strategic sales and investments so Adani’s are actively managing their portfolio with a current decision to sell a 2.84% stake in Ambuja Cements for it to rise approximately 4200 cr INR. This move is part of a long-term strategy to maintain desired equity across various businesses.

What’s Adani’s Group Financial Outlook?

The group is on track to pass a combined EBITDA of 1 trillion INR in the year 2025, to grow its infrastructure, power, and green energy sectors. This growth will further increase by a prominent investment including a planned 2 billion INR share sale in Adani enterprises.

Adani Group’s debt has decreased to 1.81 trillion INR in March 2024 down from 1.86 trillion INR the previous year. This reflects a strategic focus on improving financial health amid controversies.

Adani’s Group is Expanding the Territory: Plans

News has come out that Adani has announced ambitious plans to expand, with a capital expenditure of 90 billion INR projected in the next decade. This will further enhance the group’s Market value and financial standings.

Current status of Adani Group

With all the controversies, Adani still managed to reclaim the status of the richest man in Asia with a net worth that fluctuates significantly because of market conditions. His strategic planning and expansion have kept him at the forefront of India’s economic landscape, making him a visible figure in business as well as the political sphere.

He has officially once again reclaimed the position and crossed Mukesh Ambani to become the richest man in India and Asia together

Stick with us to know more about Business News

This text is written by Kashaf Muhammad