Walk back Two-three years. If you want to order perfume for your friend’s birthday, when is your cut-off date to order? 1 day prior if you have an Amazon Prime account.

Come to the present, can you call it “Express delivery” for Flipkart’s 2-day delivery or Amazon’s one-day or same-day delivery? No right?

The reason is obvious – Quick Commerce. Blinkit can deliver the very same perfume (provided it’s listed in Blinkit) in less than 10 minutes! Duh…

And did you notice the growth of Blinkit? – Imagine going from a regular grocery startup to being worth more than your parent company – that’s Blinkit’s story in a nutshell. In the world of India’s quick commerce, Blinkit is now more valuable than Zomato, the very company that bought it in 2022. Blinkit’s valuation has shot up to approximately $13 million, and it now holds a whopping 46% market share of India’s 23,000-crore quick commerce industry. Impressive, right?

Let’s dive into the secret sauce that makes Blinkit a leader in this space and see how it’s transformed from a promising startup to an industry heavyweight.

Table of Contents

Blinkit’s Financial Rocket Boost

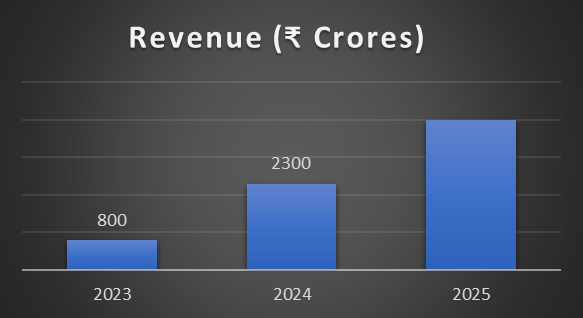

This growth story isn’t just about fancy valuations. Blinkit’s revenue has exploded! We’re talking a jump from ₹800 crores to ₹2,300 crores – almost tripling in a short period. The best part? They’re projected to break even by FY 2025, meaning they’ll start making steady profits very soon.

Yes, you might wonder. I was just telling you how Blinkit is growing at a rapid speed surpassing its own parent company – Zomato. But they are gonna Break even (no profit no loss point) only by 1st quarter of 2025. Come again? Doesn’t growth mean huge profits?

I can get you. But here’s the deal. Quick commerce has been actively evolving in India only for the past 2-3 years. And the profit margin for companies in this sector is minimal. It’s like a looooooot of things had to happen in the background to deliver that one order within their promised time of 10-15 minutes.

So, how do these companies grow? One concept is economies of Scale. In simple terms mean, the more they sell the more they earn – profit-wise. And no it is not a bad thing to not achieve breakeven yet. At the growing pace, Blinkit – an Indian company has the capability to surpass the mighty Amazon in the next decade!

How Does Blinkit Make Money? Let’s Break It Down:

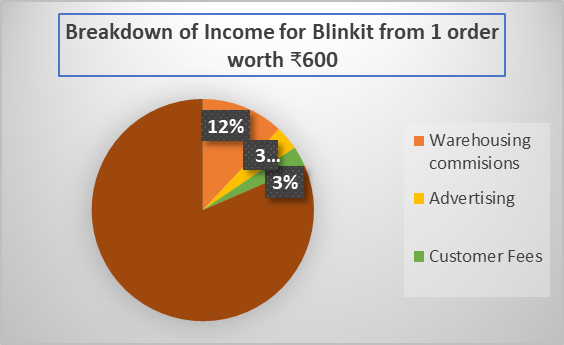

Now, the big question is: How is Blinkit earning all this cash, especially in a highly competitive market? Here’s what happens on an average order worth ₹600. Blinkit pockets about ₹110 by blending different revenue streams.

The table and chart below show the proportion of income earned by Blinkit from an order (for average order size):

|

Revenue Stream |

Percentage |

Revenue per order |

|---|---|---|

|

Warehousing commissions |

11-13% |

₹ 72.00 |

|

Advertising |

2.3-3.5% |

₹ 21.00 |

|

Customer Fees |

3% |

₹ 18.00 |

So, from warehousing services and marketplace commissions (11-13%), Blinkit earns ₹72 per order. Add advertising (₹21 per order) and delivery charges (₹18), and Blinkit pulls in about ₹110.

|

Total Revenue |

₹ 110.00 |

|---|---|

|

Less: Last-mile Delivery |

₹ 42.00 |

|

Less: Dark Store Operations cost |

₹ 39.00 |

|

Contributing profit |

₹ 29.00 |

What about costs? Last-mile delivery eats up ₹42 per order, dark store operations cost ₹39, and other expenses are minor. After all of that, Blinkit still earns around ₹15 per order as a contributing profit.

Note: We are discussing here the contributing profit and not the actual net profit. In simple English, only variable costs(costs that vary with the level of units) are considered for the calculation of contribution. Fixed expenses like Dark Store rent, salaries, etc are considered for the company as a whole to arrive at Net profit.

Why Blinkit’s Strategy is Spot-On

- Dark Stores: The Secret to Lightning-Fast Deliveries

What makes Blinkit stand out in the quick commerce space? It’s their well-oiled “dark stores.” These are special warehouses located close to high-demand areas, enabling Blinkit to deliver orders within 15-20 minutes. Efficiency at its best! With 451 dark stores spread across 27 cities, Blinkit can quickly restock and serve customers at an unbeatable speed.

Do you remember how conflicts arose when the 10-minute Guaranteed Delivery was introduced first – concern about Driver’s safety, pressure on drivers, is even possible, etc? The answer to this is the well-located “Dark stores”. And not just the location, but also the operating efficiency. As soon as you place the order, Blinkit focuses on dispatching your order ASAP creating extra time for the delivery partners to deliver your order.

- Higher Average Order Value (AOV): Bigger is Better

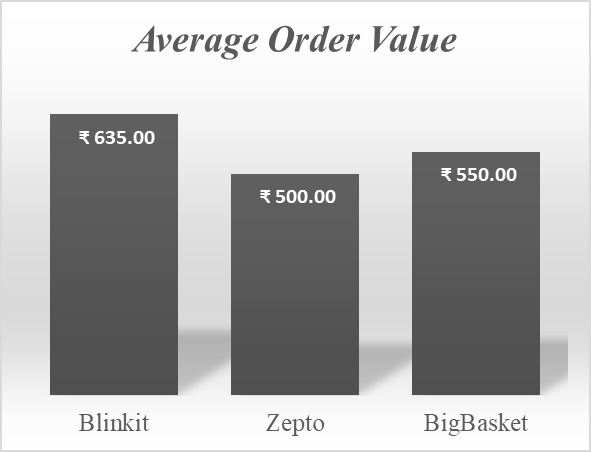

One of Blinkit’s secret weapons is its high average order value (AOV), which sits at ₹635—higher than many of its competitors like Zepto and BigBasket. A higher AOV means Blinkit is delivering larger grocery orders, making each delivery more profitable. It’s all about scaling the right way.

- Leveraging Zomato’s Reach

Let’s not forget Zomato’s massive role in Blinkit’s growth. With Zomato’s user base of 100 million, Blinkit taps into a vast network of potential customers. Imagine browsing for your dinner on Zomato and, with just one click, being able to add your grocery essentials too! Thanks to this seamless integration, Blinkit saw a 33% jump in its monthly user base after the acquisition.

Ever wonder why Zomato and Blinkit aren’t combined into one app? It seems like a no-brainer for convenience, right? But there’s a reason behind it. Zomato’s CEO, Deepinder Goyal, believes Blinkit has built a strong, recognizable brand in the quick commerce space, and merging it with Zomato might dilute that identity. By keeping Blinkit as its own app, they’re ensuring it stays unique and continues to stand out, while still benefiting from Zomato’s massive reach. It’s about letting Blinkit shine on its own!

The Future of Quick Commerce: Blinkit’s Game Plan

Blinkit’s rise is no fluke. Their focus on scalability through dark stores, boosting profitability with high AOVs, and leveraging Zomato’s expansive reach has set them up as a market leader. As it continues to refine its model and expand into more cities, Blinkit is expected to keep disrupting the quick commerce industry in India.

Will Blinkit continue to grow, break-even, and lead the market? All signs point to yes. Keep an eye on this game-changing company!

This story is more than just numbers. Blinkit has cracked the code of quick commerce with speed, efficiency, and smart partnerships—making them a company to watch as they continue to shape the future of online grocery shopping in India.

I bet your next Blinkit order won’t look the same. While waiting for your order, somewhere in your subconscious, you are gonna be working out the processes that are bringing your order to you.

See you soon, with yet another interesting case study!

And for more such case studies stick with us.

Kalaivani Kandhakumar wrote this article.