Tolins Tyres IPO: What do you do with your hard-earned money? You spend a good amount of it on your needs and wants and you decide to save a portion of your salary/income. You have lots of options to save money, and one of the high-return savings would be investing in Stocks. Too much jargon? Here are the layman’s terms-

Stocks – a share in ownership of a company. And as the company grows, your investment return grows with it.

IPO? It’s when a private company sells its shares to the general public for the first time.

Let’s dive right in, learning more about Tolins Tyres’s IPO, what are the terms, and relevant dates.

Table of Contents

Tolins Tyres – An Intro

We have heard about the big MRF, CEAT, and Apollo Tyres. Well, Tolins Tyres are there in line to capture the global market.

Tolins Tyres, a tire company from Kerala, is well known for its established niche in retreading tires. They are also one of the leading manufacturers of tires, not just for highway vehicles, but also the common two-wheelers and three-wheelers.

Furthermore, Tolins Tyres also has an expanded market exporting tires to 40 countries, to the Middle East, Africa, and South America, where there is continuous growing demand.

Terms of Tolins Tyres IPO

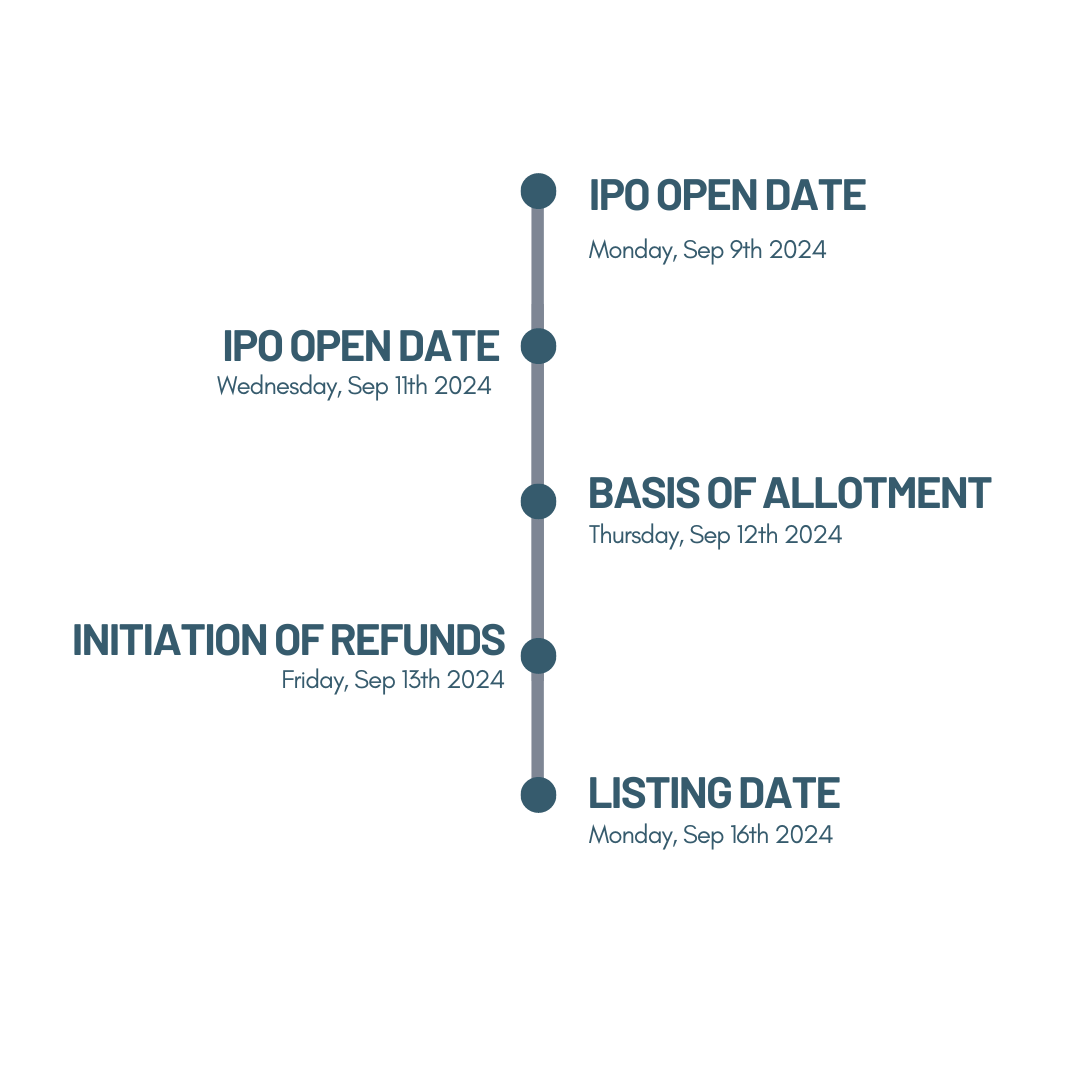

- The dates: Tolins Tyres IPO starts today 9th Sep, 2024. And will be closing on 11th Sep. The shares from this IPO shall be allotted on 12th Sep and are likely to be listed on BSE and NSE on 16th Sep.

- The Numbers: IPO is issued to raise capital for ₹230 crores – out of which ₹200 crores shall be raised through fresh issue of 0.88 crore shares. The balance of 0.13 crore shares totalling ₹30 crores is through an offer for sale.

- The Limit: Tolins Tyres IPO price band is set at ₹215 to ₹226 per share (Face value – ₹5 per share). The minimum lot size for the Retail investors is 66 shares and multiples thereon (maximum of 13 lots), meaning a minimum investment of ₹14,916 is required. As for the site, a minimum of 14 lots (924 shares in total) amounting to ₹2,08,824 is the minimum bet(67 lots as maximum). And its 68 lots for a total of ₹10,14,288 is the limit for bNII.

- Registrar: Cameo Corporate Services Limited is the registrar for IPO.

What are Tolins Tyres’ plans for the IPO Proceeds?

- Repayment and/or prepayment of the company’s debt.

- Working capital expenses.

- Investment in a wholly-owned subsidiary – Tolin Rubbers Private Limited to repay and/or prepay some of its debt and working capital expenses.

- General corporate purposes.

GMP

The GMP for Tolins Tyres as of 9th Sep 2024 is ₹39 per share, which simply means that with a price band of ₹226, the listing price is expected to be ₹265 (226+39). Since GMP is high, it is considered to be a comparatively better IPO to invest in.

Other Pros of Tolins Tyres

- Diverse products – manufacturing tires for multiple sectors and retreading tires (giving new life to old tires), it is welcome among commercial vehicle owners.

- Global reach – In addition to India, Tolins Tyres is also serving the needs of Africa, the Middle East, and South America, where the requirement is booming.

- Growing Industry – Infrastructure development provides an opportunity for growth in the current market.

Cons of Tolins Tyres – The risk factors

- Raw Material Costs – manufacturing tires solely depends on the raw material Rubber. Hence, the price fluctuations in the raw material price could affect the profit of Tolins Tyres.

- Tough Competition – With legends like MRF, CEAT, and APOLLO capturing the market, it can be pretty challenging to grow and change its path.

- Export Risks – Higher Exports might bring in the exchange fluctuation risks.

Conclusion: Is Tolins Tyres IPO a Good Bet?

Overall analysis of the above data can help us conclude that Tolins Tyres is a pretty decent bet considering the high GMP. The growth opportunities due to diverse products, global markets, and good industry trends are an encouraging sign.

However, challenges such as forex risk, raw material price fluctuations, and big competition are not to be overlooked when making a financial decision.

So should you Invest? Well if you believe in the growth trends of industry and global markets and are ready to take a bit of risk from competition, Tolins Tyres would be a good fit for your portfolio.

Pro tip: Invest Wisely and make sure it aligns with your risk appetite. After all, no tire rolls smoothly without a few bumps along the road.