Ola Electric has been one of the most dominant names in the Indian electric vehicle market; however, at the moment, it is fighting numerous controversies that have drastically reduced its popularity and market share. This piece explores the most sensitive issues surrounding the firm, customer dissatisfaction, internal wrangles, and governmental repressive measures.

Table of Contents

Decline of Market Share: A Nasty Trend

The market share of Ola Electric had depreciated drastically from nearly 50% as of April 2024 to a mere 27% by September 2024. A steeper downfall is portentous of more fundamental issues plaguing the company- such as service inefficiencies and increasing competition from dominant players like Bajaj and TVS, both of which are rapidly increasing their market presence. Analysts also note that sales at Ola have gone down sharply with the number of registrations having dropped by 11% MoM, the lowest since October last year.

Customer Grievances: A Successively Deteriorating Scam

The Central Consumer Protection Authority (CCPA) has issued a showcase notice to Ola Electric following numerous complaints filed by customers of the company. Reports indicate that between September 1, 2023, and August 30, 2024, the National Consumer Helpline reported a total of 10,644 complaints, many of which were about delays in services and manufacturing defects. Customers reported complaints such as:

Delayed in service (3,389 complaints)

Delayed delivery of new vehicles (1,899 complaints)

Failed to deliver promised services (1,459 complaints)

These grievances emphasize severe lapses in the post-sale service and quality check of Ola.

Public Scandal: Bhavish Aggarwal v/s Kunal Kamra

To pour some petrol to the fire, there’s public outcry between Ola’s CEO Bhavish Aggarwal and stand-up comedian Kunal Kamra. This one started as Kamra made the company service quality a form of attack post on social media with pictures of dozens of scooters lined up for repair at an Ola service center. Reactionally, Aggarwal responded to Kamra by labeling him a “failed stand-up comic” and pulled him up for creating sponsored content. The subsequent exchange not only brought attention to service issues but also concentrated on Aggarwal’s thoroughly defensive position at a time when he was attracting criticism piling up.

Regulatory Scrutiny: Government Involvement

The issue deteriorated when the Ministry of Heavy Industries (MHI) demanded an investigation into the company’s warranty obligation adherence and service quality. The issue takes on additional relevance in that it relates to production-linked incentives tied to quality measures36. The government’s reaction smells of seriousness attached to problems plaguing Ola Electric and calls into question its operational credibility.

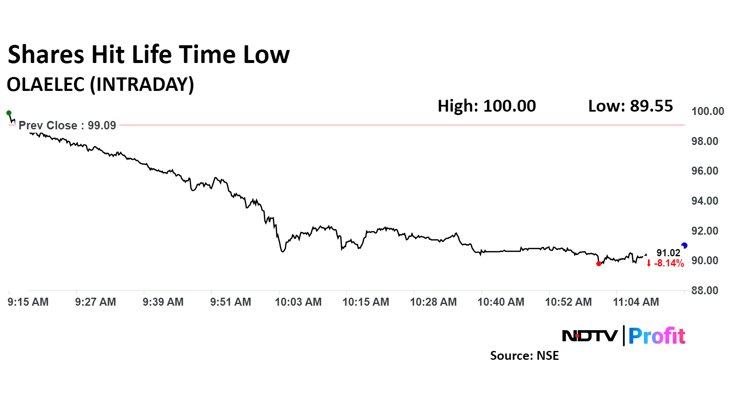

Financial Implication: Sock Performance

)

Ola Electric has been on a slippery slope since its IPO date in August 2024. After touching a post-listing high of INR 157, the shares tanked more than 42% with a recent closing around INR 85.21. This fall goes straight in tandem with the increase in customer complaints and negative media focus regarding the company’s service capabilities.

Competition Raking In Ground

While Ola Electric does its best to stay ahead of the curve, other brands are getting the last word. Bajaj Auto claimed a multi-fold jump of 166% year-on-year in sales for September 2024. That took the competitiveness curve a notch higher for Ola Electric. Increasingly, looking at the trend with competitors enhancing their networks and gaining more customer confidence, Ola must act in time to make up for the mistakes and not let the market further shrink.

Conclusion: Ola Electric at a Tipping Point

This becomes a crossroads for Ola Electric, as it needs to immediately tackle customer complaints if it hopes to restore investor confidence. Declining market share, regulator scrutiny, financial losses, and public relations mean that the once-thriving electric vehicle manufacturer may be in line for a very grim future. Time will tell if Ola manages to regain the position it had attained or falls into the usual connotation of being another cautionary tale in this fast-evolving electric vehicle industry.

Read this also: Infosys Q2 Results: Net Profit Growth Of 4.7% to Rs 6,506 Cr and Revenue 5.1% to Rs 40,986 Cr.

This text is written by KASHAF MUHAMMAD