We’ve hit the end of the second quarter for the 2024-25 financial year, and this month is all about getting the inside scoop on how our favorite companies are doing. From their financials to big strategic decisions, we’ll finally get a clearer picture.

Speaking of, Wipro’s Board of Directors is set to meet on October 16-17 to give us the lowdown on where the company stands.

But before we dive into that, let’s quickly check out who Wipro is and take a peek at their Q1 results. Let’s jump right in!

Table of Contents

Wipro – an Intro

Wipro is one of those cool companies that started surprisingly—making vegetable oil in 1945! Fast forward, and now it’s a global tech powerhouse helping businesses across industries tackle everything from cloud computing to digital transformation. Whether it’s improving how companies operate or beefing up their cybersecurity, Wipro is all about innovation.

Plus, they’re super focused on sustainability, aiming to build a tech-driven future that’s smarter and greener. It’s safe to say they’ve come a long way!

Wipro FY 2024-25: Q1 Financial Results

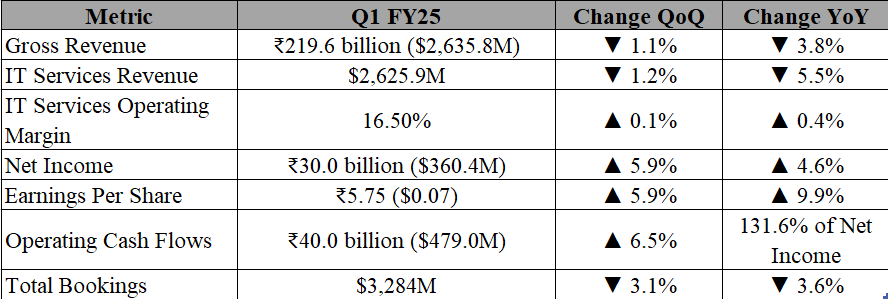

Here’s a quick breakdown of how things shaped up for the quarter ending June 30, 2024. While there were some declines in revenue, the company still managed to show strength in other areas, like net income and cash flows.

Key Highlights:

- Gross revenue dropped slightly, down by 1.1% QoQ and 3.8% YoY.

- IT services revenue saw a 1.2% QoQ dip and a 5.5% YoY decline.

- Net income was up, showing a solid growth of 5.9% QoQ and 4.6% YoY.

- Earnings per share (EPS) also grew by 5.9% QoQ and an impressive 9.9% YoY.

- Operating cash flows hit ₹40 billion, a 6.5% rise YoY, standing at 131.6% of net income.

While revenues took a hit, the company has maintained strong profits and cash flows, which is always a good sign. Voluntary attrition remains at 14.1%, keeping talent retention a key focus area.

Here’s an interesting twist—after a major reduction of 6,180 employees last quarter, the company flipped the script this time around. They added 337 new hires, bringing the total headcount to 234,391 from 234,054 at the end of March 2024. It’s a small bump, but still, it’s great to see them moving in the opposite direction now!

Can we expect the same in Q2 results? We have to wait and watch!

Wipro’s Q2 Results: Date and Time

Wipro announced yesterday(Oct 1st) that its board of directors will be meeting on October 16-17, 2024, to review and approve the company’s condensed audited standalone and consolidated financial results for the quarter and half-year ending September 30, 2024.

Wipro Announces Trading Window Closure

Wipro has just let everyone know that its trading window is closed from September 16 to October 19, 2024. Basically, if you’re an employee or someone with insider knowledge, you’ll have to hit pause on buying or selling the company’s shares during this time.

It’s a standard move to make sure no one has an unfair edge ahead of any major announcements or updates. So, while things are locked down for now, it’s all about keeping everything fair and square!

Conclusion

So, as we gear up for Wipro’s Q2 results, it’s clear that while the first quarter saw a few bumps with revenue, the company has shown resilience with strong profits, impressive cash flow, and even a bit of growth in headcount. With the board meeting set for October 16-17, we’ll soon get the full scoop on how they’re doing and what moves they might be planning next.

Will they continue this momentum? Or are there more surprises in store? Either way, it’s going to be exciting to see where Wipro is headed. Stay tuned for the updates—you won’t want to miss it!

For more such updates and business knowledge subscribe to us.

Kalaivani Kandhakumar wrote this article.